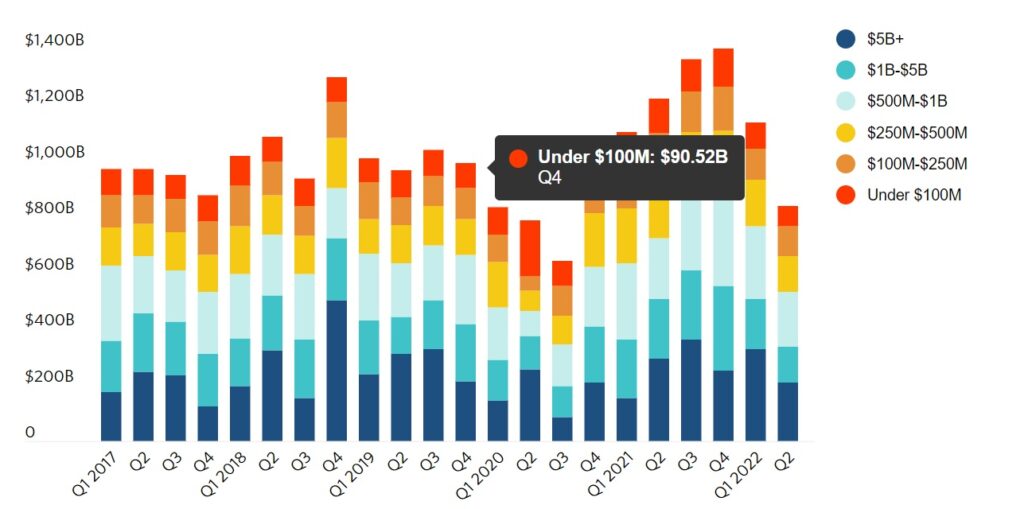

Investors and companies across the globe have been contending with the continuous inflation, geopolitical tension, and supply chain that has been affected by the pandemic greatly, and this scenario has been existent all across the globe. According to recent data, the deal volume of Global M&As has been on a downward spiral ever since Q2 in 2022.

There was a record-setting pace last year, and this year has been lagging behind. Most investors and corporations have completed transactions that are worth around $1.09 trillion in the second quarter. For sure, there has been a decline which stands at around 26% in comparison with the last quarter.

Deal volumes have also been lagging in the North American M&A space. As per data, there have been 4,571 deals that have been closed in the same period, with a total of $547.8 billion, which has been down by 30.2% and 37.6% respectively, if the figures of Q4 2021 are being calculated.

On an estimate, Europe saw M&A transactions that were worth $365 billion that closed in Q2, the deal volumes have been down by 36% as compared to the previous quarter. Amid all this, what is worth noting is that despite the economic and financial crisis, there have been private equity buyers that kept their market share of European M&A deals growing.

There have been cooldowns in mergers and acquisitions in other sectors like healthcare, IT and consumer products as well. Talking about healthcare, the deal flow in Q2 had fallen to the lowest level ever since the pandemic hit, showcasing the greatest decline for the third quarter straight.

In the IT space, deal volumes had fallen to almost 43% from the first quarter to $167 billion in Q2, this was because there was a hike in rates that resulted in the tech stocks’ valuation being dragged down. But, it is worth mentioning that even in spite of this drastic decline, the IT space had been the most active sector, which comprised around 20% of global M&A in this quarter, just behind the B2B and B2C space.

On the bright side, there have been various industries that shined brightly amid all the prevailing gloom. Such sectors are logistics, travel and hospitality. Another space was the energy space where commodity prices have been high, with the energy’s share of the global M&A market climbing to 12% in Q2, which is just double from the last quarter.

According to analysts, there are a lot of factors that could affect the deal-making in the M&A space. At a time when inflation has been soaring high, the Federal Reserve has been ratcheting up its benchmark interest rate in order to balance and cool down the economy. The deal volumes across Europe are expected to slow down throughout 2022, as most companies across Europe have been struggling with the rate hikes by the European Central Bank, and of course inflation.